太郎

太郎「投資信託とETFの違いを知りたい」

花子

花子「投資信託とインデックスファンドは何が違うの?」

本記事では、そういった疑問を解決します。

✔本記事の内容

✔本記事の信頼性 「投資家ドットコム」を運営する「ロニイ」と申します。

「投資家ドットコム」を運営する「ロニイ」と申します。

好きなものは「投資」、趣味は「投資」、夢は「偉大な投資家」です。

今回は「投資信託」「インデックスファンド」「ETF」の違いについて解説します。

結論から申しますと、インデックスファンド、アクティブファンド、ETFはすべて投資信託の種類のひとつです。

それぞれの金融商品の特徴をひとことで表すと下記のようになります。

- インデックスファンド→日経平均株価などの代表的な株価指数に連動する投資信託

- アクティブファンド→ファンドマネージャーに委託して利益を出す投資信託

- ETF→株式のように秒単位で価格が変動する投資信託

図にするとつぎのように示すことができるでしょう。

本記事では、投資信託・ETF・インデックスファンドの違いを分かりやすく解説していきたいと思います。

それでは、さっそく見ていきましょう。

ネクシィーズ・トレードのサイトにジャンプします

投資信託の種類

投資信託とは

投資信託とは何なのでしょうか?

業界団体である投資信託協会の見解によると、投資信託の定義は下記のとおりです。

投資信託とは、一言でいえば「投資家から集めたお金をひとつの大きな資金としてまとめ、運用の専門家が株式や債券などに投資・運用する商品で、その運用成果が投資家それぞれの投資額に応じて分配される仕組みの金融商品」

難しいですね。

かみ砕いて説明すると、個人投資家から集めたお金をプロに預けて増やしてもらう商品のことです。「投信」や「ファンド」とも呼ばれています。

投資信託では数多くの投資家を募ることで、ひとりでは買えない商品に投資をすることもできます。

例えば、日経平均株価の構成銘柄をひとりで購入しようとすると約7000万円必要です。

普通の人であれば7000万円も資産はありませんよね。

そこで開発されたのが投資信託です。

投資信託を利用することでLINE証券のようなネット証券だと一口100円から購入できるようになりました。

投資信託にはアクティブファンド、インデックスファンド、ETFという3種類の投信があります。

インデックスファンドとは、S&P500や日経平均株価といった代表的な株価指数などに投資することで、利益を出そうとする投資信託のことです。

一方で、アクティブファンドは投資資金をファンド・マネージャーに預けて、ファンド・マネージャーの裁量で利益を出そうとする投資信託のことです。

ETFは上場投資信託とも呼ばれ、株式と同じようにリアルタイムで取引をすることができます。

海外(主に米国)のETFにも投資することができます。

それぞれの投資信託(ファンド)の特徴は表のとおりです。

| 手数料 | 特徴 | |

|---|---|---|

| インデックスファンド | 低い | 平均的なリターンを狙える |

| アクティブファンド | 高い | ファンドにより異なる |

| ETF | 商品により異なる | リアルタイムで価格が変動する |

ETFのなかには、インデックス型のETFとアクティブ型のETFがあります。

アメリカの資産運用大手「バンガード」が運用する海外ETFと日本の資産運用会社が運用するインデックスファンドを比較した場合、海外ETFのほうが割安で投資できるといわれています。

ただ海外ETFに投資するときは、通貨を米ドルに換えるなどの手間がかかります。

また投資初心者にとって、常に価格変動するETFへ投資するのは精神的によくないでしょう。

そのため「投資家ドットコム」では初心者の投資の入口としてインデックスファンドをオススメします。

投資信託のコストとリスク

信託報酬・リスクについても説明しておきます。

投資信託には5つの手数料が必要です。

| 申込手数料 | 購入時に必要な手数料 | 購入時0~3.3% |

| 信託報酬 | 毎年かかる手数料 | 年0.09%~4% |

| 監査報酬 | 監査法人に支払う手数料 | 年0.1%未満 |

| 売買委託手数料 | 運用会社が売買するときに支払う手数料 | 投信により異なる |

| 信託財産留保額 | 投資信託解約時に支払う手数料 | 年0~0.3% |

それぞれ見ていきましょう。

申込手数料は、購入時に必要な手数料です。

購入時手数料ともいいます。

多くのアクティブファンドでは「購入価額に、3.3%を上限として、販売会社が別に定める手数料率を乗じて得た額となります。」という注意書きをしていますが、申込手数料がかかる投資信託はオススメできません。

ノーロードと呼ばれる申込手数料が無料のインデックスファンドも増えてきています。

投資信託を購入するさいには、申込手数料がかからないファンドを選びましょう。

信託報酬は、すべての投資信託に掛かるコストです。

アクティブファンドの高いもので3~4%、インデックスファンドの安いものでは0.1%未満と、投資信託により必要なコストは変わってきます。

インデックスファンドでは0.5%未満、アクティブファンドは0.1%未満の投資信託を選びましょう。

監査報酬は、投資信託の監査に使われるコストです。

投資家の資産を守るためにも必要不可欠といえるでしょう。

運用会社により異なりますが、0.1%未満の会社がほとんどですので、あまり気にする必要はないといえます。

※監査報酬を明示していない資産運用会社もあります。

売買委託手数料も、すべての投資信託に掛かるコストです。

投資家から資金を集めて実際に株式や債券を購入・売却する際、資産運用会社は証券会社に売買手数料を支払わなければいけません。

ただし、売買委託手数料を気にしていたら投資などできませんから気にする必要はありません。

信託財産留保額は、投資信託を解約した投資家が支払う必要がある手数料です。

投資信託の基準価額に上乗せされるため、長期で投資信託をもつ投資家にとってはメリットの大きいコストといえるでしょう。

信託財産留保額がない投資信託もあります。

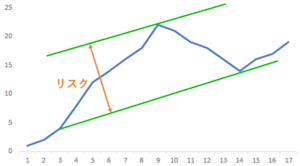

投資信託のリスクについても解説しておきます。

投資信託は現預金と異なり元本が保証されていません。 1年で基準価額が70%上昇することもあれば、40%下落することもあるでしょう。

※基準価額・・・株式でいうところの株価。ふつうは投資信託の運用開始日(設定日)を10000とします。

そのため、リスク管理には細心の注意を支払う必要があります。

何よりも信託報酬が低い投資信託を選ぶことが重要です。

信託報酬は毎年かかるコストであるため、0.5%程度の差でも長期でみると大きな差になってきます。

投資信託を購入するさいには、必ず信託報酬を確認しましょう。

またアクティブファンドではなくインデックスファンドを選ぶことも重要です。

華やかな成績を収めているアクティブファンドもありますが、将来に渡って優れた成績を保証するものではありません。

リターンが安定しやすいインデックスファンドを選びましょう。

インデックスファンドとは

インデックスファンドとは、S&P500や日経平均株価といった株価指数に投資する投資信託のことです。

日経平均株価・・・日本の上場企業のうち225の銘柄で構成される株価指数。ユニクロを展開する「ファーストリテイリング」や「ソフトバンクグループ」の割合が高い。

S&P500・・・アメリカを代表する500銘柄で構成される株価指数。「アップル」や「アマゾン」「マイクロソフト」の割合が高い。

株価指数とは多くの企業の株価を集めてつくった価格のことで、インデックスファンドでは株価指数に投資することで安定した利益を得ようとします。

非課税投資制度である「つみたてNISA」に多く採用されているのもインデックスファンドであり、株価指数へ投資をしておくと、投資先の国全体の成長に伴いリターンを得ることができます。

※通貨の暴落といった例外はあります。

例えば、アメリカでは長期の経済成長が続いており、40年で30倍近くS&P500が上昇しています。

日経平均株価もここ10年で急激に上昇しています。

日経平均株価やS&P500以外にも多くの株価指数があります。 世界のおもな株価指数は下記のとおりです。

| 特徴 | 国名 | |

|---|---|---|

| S&P500 | 米国500社から構成 王道中の王道 | アメリカ |

| ナスダック100 | GAFAなどのIT企業100社から構成 この10年で大幅値上がり | アメリカ |

| ダウ工業平均株価 | 米国の30社から構成、IT企業比率低め | アメリカ |

| 日経平均株価 | 日本の225社から構成、入れ替わりが少ない | 日本 |

| 上海総合指数 | 中国企業1493社から構成 | 中国 |

| 香港ハンセン指数 | 中国・香港企業80社から構成、中国企業も多数組み入れ | 香港 |

| ユーロストックス50指数 | 欧州の企業50社から構成 | 欧州11か国 |

| DAX指数 | ドイツの30社から構成、銀行銘柄少なめ | ドイツ |

| FTSE100指数 | イギリスの100社から構成、ロンドンの取引所の8割占める | イギリス |

| SENSEX指数 | インドの30社から構成、財閥企業多め | インド |

…数が多すぎて、どの株価指数に投資をすればいいか分かりませんよね?

そこでオススメなのが全世界の株価指数であるMSCI「オール・カントリー・インデックス」です。

MSCI「オール・カントリー・インデックス」は時価総額ベースで世界の上場企業の85%をカバーしており、MSCI「オール・カントリー・インデックス」に連動する投資信託を購入すれば、世界経済へ投資することができます。

日本でMSCI「オール・カントリー・インデックス」に連動する投資信託を購入するなら、三菱UFJ国際投信が運用する「eMAXIS Slim 全世界株式(オールカントリー)」がオススメです。

下記の記事を参考にしながら資産運用を始めてみてください。

アクティブファンドとは

アクティブファンドとは、資産をファンドマネージャーに預けて替わりに運用してもらう投資信託のことです。

インデックスファンドが有名になるまで投資信託といえばアクティブファンドを指すのが一般的でした。

「銀行や郵便局で勧められた投資信託で損をした」という話をよく聞くかと思います。

その大きな原因はアクティブファンドの信託報酬の高さです。

さきほど紹介した「eMAXIS Slim 全世界株式(オールカントリー)」の信託報酬が0.1%程度であるのに対し、アクティブファンドの平均信託報酬は1.5%となっています。

つまり、アクティブファンドを購入した時点で購入手数料と信託報酬の分だけ「マイナス」から運用をスタートすることになります。

そのため、アクティブファンドを購入するさいには、購入手数料がかからないノーロードや信託報酬が安いものを選びましょう(信託報酬の目安としては1%を下回るものがいいと思います)。

ETFとは

ETFを一言で表すと「時価で取引できる投資信託」といえるでしょう。

東京証券取引場が開いている平日の9:00~15:00には株価と同じように価格が変動します。

常に価格が気になるよう繊細な方にはオススメできない投資信託です。

本記事を書くにあたり、東京証券取引所に上場するETFを調査したのですが面白いETFが結構ありました。

- サムスングループ指数

- 貴金属バスケット(金、銀、白金、パラジウム)

- UBS ETF スイス株

サムスングループやスイス株のETFが日本で売れるとは思わないのですが、資産運用の幅が広がるのは素晴らしいことです(笑)

ETFは何らかの指数(株価指数や債券指数、REIT指数など)に連動するように開発されます。

そのため、インデックス投資に少し似ているのですが、運用会社は指数を自ら作り出せるので、インデックス投資に近いETFとアクティブ運用に近いETFがあります。

個人投資家のなかでは「ETFとインデックスファンド、どちらのほうがいいのか?」とよく議論になりますが、正直どちらでもいいでしょう。

ただ個人的には1日に1回しか価格が公表されないインデックスファンドのほうが良いと考えています。

「S&P500」「日経平均株価」「ダウ工業平均株価」といった主要な株価指数であれば、インデックスファンド・ETFどちらもラインナップは充実しているため、自分の性格に合う方を選んでください。

投資信託の選び方

資産が数百万円程度であれば、ある程度の現金を残して株式型インデックスファンドやETFに投資をしておけばよいでしょう。

投資信託を選ぶときには信託報酬が低く、信頼のある株価指数に連動したものにするべきでしょう。

おすすめの投資信託をいくつか紹介しておきます。

- eMAXIS Slim 全世界株式(オールカントリー)

- SBI 全世界株式インデックスファンド

- SBI・バンガード・S&P500インデックスファンド

- eMAXIS Slim 米国株式ETF(S&P500)

- iシェアーズ S&P500 米国株ETF(1655)

- iシェアーズ MSCI ACWI ETF(世界中に投資)

iシェアーズは米国の資産運用会社大手「ブラックロック」が運用するETFシリーズで、信託報酬が安いことで有名です。

ほかにも「バンガード」「ステート・ストリート・グローバル」といった運用会社が良質なETFを運用していますので、興味があればぜひ調べてみてください。

証券会社の選び方

日本にはネット証券と呼ばれるオンラインで取引をする証券会社と、対面証券という店舗で取引をする証券会社があります。

証券会社の選び方は人それぞれだと思うのですが、投資を始める際には少額で始めるべきだと思います。

そこでオススメなのがLINE証券です。 LINE証券ではLINE証券のアプリから簡単に入金できますし、操作性も非常に高いです。

また100円からeMAXIS Slim 全世界株式(オールカントリー)を購入できるという大きなメリットもあります。

マイナンバーカードか運転免許証があれば5分で口座開設できる点も大きな魅力でしょう。

口座をお持ちでない方は公式ホームページから証券口座を開設してみてください。

まとめ:投資信託には様々な種類がある!

今回は「投資信託」「インデックスファンド」「アクティブファンド」「ETF」の違いについて解説しました。

多種多様な投資信託があることや、それぞれの投資信託の違いを理解していただけたでしょうか?

結論としては「eMAXIS Slim 全世界株式」のような信託報酬の安いインデックスファンドを選んでおけばOKということです。

人生は短いですから、投資や資産運用が好きな人以外はサクッと資産運用の準備を終わらせて、自分の好きなことや仕事に打ち込むのがベストだと思います。

「eMAXIS Slim 全世界株式」をさらに知りたい方は下記の記事にて解説していますので、ぜひ読んでみてください。

今回も最後まで読んでいただきありがとうございました。 もしよろしければ、ツイッターのフォローとリツイートをお願いします。

それでは、また。