太郎

太郎全世界株式、全米株式、S&P500…比較する株価指数が多すぎるんだよな…

花子

花子結局、どのインデックスファンドに投資をすればいいのでしょうか?

そんなお悩みを解決します。

結論、全世界株式に連動するファンドがオススメですが、全米株式・S&P500でも問題はありません。

なぜそのような結論に至ったのか、詳しく説明していきます。

ネクシィーズ・トレードのサイトにジャンプします

【結論】全世界株式がオススメです

結論から言うと全世界株式に投資するファンドがオススメです。理由は2点あります。

- どの国が成長するかは分からない

- 幅広い業種に投資可能

それぞれ見ていきましょう。

理由①:どの国が成長するかは分からない

理由の1つ目はどの国が成長するか分からないためです。

図解で考えてみましょう。

- 全世界株式

- 全米株式

- S&P500

3ジャンルを比較すると次のようになります。

全世界株式→全米株式→S&P500の順番に投資対象が狭まっており、全世界株式の分散効果の高さが分かりますね。

全米株は小型株にも投資しているため銘柄数が非常に多くなっています。

全世界株式ファンドでは米国企業のみならず新興国、欧州、日本にも投資をしているため、米国の成長が減速してもその影響を受けづらいという利点があるわけです。

例えば、2000年代の米国の株式市場はほとんど成長しませんでした。一方で新興国であるインドや中国の株価指数は急激に成長し、日本国内でも新興国に投資するファンドの売上が伸びたそうです。

2010年代は米国、なかでもGAFAMをはじめとするIT企業の成長が続きましたが、2020年代もこの流れが続くとは限りません。

米国株が失速して日本株が伸びるかもしれませんし、米国株が伸びて新興国株が失速する可能性もあるでしょう。

そういった1つの国に集中投資するリスクを抑えてくれるのが全世界株式に連動するファンドなのです。

言い換えれば、今後10年間でどの地域が成長しても恩恵を受けることができます。

全世界株式、全米株式、S&P500のいずれかで悩んでいるのであれば全世界株式がいいでしょう。

理由②:成長が期待できる新興国に投資可能

全米株式やS&P500とは異なり、全世界株式では成長が期待できる新興国にも投資をしています。

全世界株式インデックスファンドの代表格である「eMAXIS Slim 全世界株式(オールカントリー)」では米国を中心にケイマン諸島や台湾にも投資していますね。

※ケイマン諸島の企業を組み込んでいるのではなく、ケイマン諸島という箱を使って中国企業が上場しているため、分類上はケイマン諸島になっています。

新興国の組入比率を見ると約12%となっているおり世界的な影響力はまだまだ小さいですが、米国に集中投資するよりもリスクを分散できるでしょう。

2030年の各国の国内総生産を比較しても、新興国の追い上げがより鮮明になっています。

| 2020年 | 2030年 | |

|---|---|---|

| 1 | アメリカ | 中国 |

| 2 | 中国 | アメリカ |

| 3 | 日本 | インド |

| 4 | ドイツ | 日本 |

| 5 | イギリス | インドネシア |

| 6 | インド | ロシア |

| 7 | フランス | ドイツ |

| 8 | イタリア | ブラジル |

| 9 | カナダ | メキシコ |

| 10 | 韓国 | イギリス |

投資先に新興国を組み込んでおくことで、「成長の果実」をそのまま受け取ることができるのです。

もちろんアメリカは成長を続けるでしょうが、人口という観点から見ると新興国の方が大きなポテンシャルを有しています。

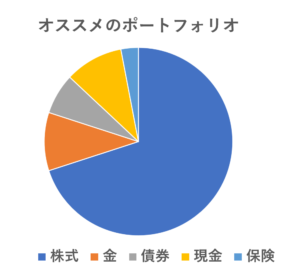

新興国と聞くと「危ない投資先」というイメージがあるかもしれませんが、ポートフォリオの1~3割程度は新興国に投資しておくべきでしょう。

リターンは全米株式やS&P500の方が高い

ただし過去のリターンを比較すると、全米株式やS&P500の方が高くなっています。

| 年数 | S&P500 | 全米株式 | 全世界株式 |

|---|---|---|---|

| 3年 | 15.5% | 15.4% | 12.7% |

| 5年 | 19.3% | 18.7% | 16.1% |

| 10年 | 21.1% | 20.7% | 16.8% |

| 20年 | 9.2% | 9.5% | 8.3% |

| 30年 | 9.9% | – | 7.7% |

※すべて円換算、S&P500、MSCI ACWI、CRSP USトータルマーケット・インデックスのみ連動ETFのVTIを利用、より引用

そのため過去のデータに基づいて資産運用をするのであれば全米株式やS&P500に投資をした方がいいでしょう。

米国は最も資本主義化された国であり、投資家を保護するスタンスが明確です。

一方で新興国の財閥企業などでは腐敗により、上場株を買う個人投資家が不利益を被るということがよくあります。

経済成長率を見ると新興国の方が高いにも関わらず株価指数が上昇しにくいのには、資本市場が整備されていないという欠点もあるからでしょう。

そのため過去のリターンのみを見て資産運用をするのであれば、全米株式やS&P500に連動するインデックスファンドを買うことをオススメします。

全世界株式、全米株式、S&P500に投資する投信を徹底比較

ここからは実際に全世界株式、全米株式、S&P500に投資しているインデックスファンドを比較していきたいと思います。

全世界株式に投資するインデックスファンド

eMAXIS Slim 全世界株式(オールカントリー)

| 運用会社 | 三菱UFJ国際投信 |

| 設定日 | 2018年10月31日 |

| 運用方式 | インデックスファンド |

| ベンチマーク | MSCI ACWI(配当込み、円ベース) |

| 購入時手数料 | 無料 |

| 信託報酬 | 0.1144% |

| 純資産総額 | 2613.93億円 |

| つみたてNISA | 対応 |

| 主な組込銘柄 | Apple,Microsoft,Amazonなど |

| ロニイの評価 | ★★★★★ |

本ブログで最もオススメしているのが、eMAXIS Slim 全世界株式(オールカントリー)です。

eMAXIS Slim 全世界株式(オールカントリー)は、米国を中心に日本・欧州・新興国に投資しており、これ1本で資産運用が完結するほどの投資信託となっています。

既に紹介しているように米国を中心に日本、欧州、新興国に投資をしており、どの国の成長もキャッチアップできるのが大きな特徴でしょう。

詳しくは次の記事を参考にしてみてください。

SBI・全世界株式インデックス・ファンド

| 運用会社 | SBIアセットマネジメント株式会社 |

| 設定日 | 2017年12月6日 |

| 運用方式 | インデックスファンド |

| ベンチマーク | FTSE グローバル・オールキャップ ・インデックス(円ベース) |

| 購入時手数料 | 無料 |

| 信託報酬 | 0.1102% |

| 純資産総額 | 351.36億円 |

| つみたてNISA | 対応 |

| 主な組込銘柄 | Apple,Microsoftなど |

| ロニイの評価 | ★★★★★ |

eMAXIS Slim 全世界株式(オールカントリー)と同じく、全世界の企業の株式に投資するのがSBI・全世界株式インデックス・ファンドです。

SBI・全世界株式インデックス・ファンドは、米国に上場するETFを通して株式に投資しているのが特徴となっています。

信託報酬を見ると、わずかにeMAXIS Slim 全世界株式(オールカントリー)よりも低く抑えられており、コストに敏感な方は SBI・全世界株式インデックス・ファンド に投資するといいでしょう。

ただし取扱金融機関はeMAXIS Slim 全世界株式(オールカントリー)の方が多いため、純資産総額にかなりの差がついています。

全米株式に投資するインデックスファンド

楽天・全米株式インデックス・ファンド

「楽天・全米株式インデックス・ファンド」は上場している、ほとんどのアメリカ企業に投資するインデックスファンドです。基本情報を見ておきましょう。

| 運用会社 | 楽天投信投資顧問 |

| 設定日 | 2017年9月29日 |

| 運用方式 | インデックスファンド |

| ベンチマーク | CRSP USトータル・マーケット ・インデックス(円換算ベース) |

| 購入時手数料 | 無料 |

| 実質的な年間負担 | 0.187% |

| 純資産総額 | 3437億円 |

| つみたてNISA | 対応 |

| 主な組込銘柄 | Apple,Microsoftなど |

| オススメ度 | ★★★★★ |

楽天・全米株式インデックス・ファンドは、楽天証券と同じグループに属する楽天投信投資顧問が運用しています。

S&P500とは異なり、米国の中小企業にも幅広く投資しているのが特徴で、成長力乏しい日本やリスクの高い新興国に投資したくない方にオススメのファンドです。

「SBI証券」、「楽天証券」、「マネックス証券」といったネット証券で購入することができます。

米国株に興味のある方は楽天・全米株式インデックス・ファンドを買ってみてはどうでしょうか。詳しくは次の記事を参考にしてみてください。

SBI・V・全米株式インデックス・ファンド

| 運用会社 | SBIアセットマネジメント |

| 設定日 | 2021年6月29日 |

| 運用方式 | インデックスファンド |

| ベンチマーク | CRSP USトータル・マーケット ・インデックス(円換算ベース) |

| 購入時手数料 | 無料 |

| 実質的な年間負担 | 0.0938% |

| 純資産総額 | 207.8億円 |

| つみたてNISA | 対応 |

| 主な組込銘柄 | Apple,Microsoftなど |

| オススメ度 | ★★★★☆ |

楽天・全米株式インデックス・ファンド よりもさらにコストを落としたのがSBI・V・全米株式インデックス・ファンドです。

実質的な年間負担は0.1%を下回っており、最安コストで全米株式に投資することができます。

一方で「SBI証券」でしか購入できないという大きなデメリットがあるため、オススメ度は4/5としました。

既に「SBI証券」の口座をお持ちの方は SBI・V・全米株式インデックス・ファンド 、それ以外の証券口座をお持ちの方は 楽天・全米株式インデックス・ファンド に投資するといいでしょう。

詳しくは次の記事を参考にしてみてください。

S&P500に投資するインデックスファンド

米国の主要企業500社に投資する株価指数がS&P500です。世界的にもメジャーな株価指数となっています。

アメリカの大企業に投資したいのであれば、次の2本のいずれかを購入すればいいでしょう。

- eMAXIS Slim 米国株式(S&P500)

- SBI・V・S&P500インデックスファンド

それぞれ見ていきたいと思います。

eMAXIS Slim 米国株式(S&P500)

| 運用会社 | 三菱UFJ国際投信 |

| 設定日 | 2018年7月3日 |

| 運用方式 | インデックスファンド |

| ベンチマーク | S&P500 |

| 購入時手数料 | 無料(ノーロード) |

| 信託報酬 | 0.0968%以下 |

| 実質コスト | 0.141% |

| 純資産総額 | 3960.2億円 |

| つみたてNISA | 対象 |

| 主な組込銘柄 | Apple、Microsoftなど |

| オススメ度 | ★★★★★ |

eMAXIS Slim 米国株式(S&P500)は、三菱UFJ国際投信が運用するインデックスファンドとなっており、信託報酬は0.1%を下回っています。

純資産総額は約4,000億円となっており、安定感を持って投資することが可能です。

世界的に有名なインデックス指数に投資したいのであれば、 Slim 米国株式(S&P500) を購入すればいいでしょう。

詳しくは次の記事を参考にしてみてください。

SBI・V・S&P500インデックスファンド

| 運用会社 | SBIアセットマネジメント |

| 設定日 | 2019年9月26日 |

| 運用スタイル | インデックスファンド |

| ベンチマーク | S&P500(円換算) |

| 購入時手数料 | 無料 |

| 信託報酬 | 0.0938% |

| 純資産総額 | 約2,000億円 |

| 主な組込銘柄 | Apple、Microsoftなど |

| つみたてNISA | 対応 |

| オススメ度 | ★★★★☆ |

SBI・V・S&P500インデックスファンドはeMAXIS Slim 米国株式(S&P500)よりも低コストに抑えられています。

ただし SBI・V・S&P500インデックスファンド は「楽天証券」から投資できないという大きなデメリットがあるため、お持ちの証券口座に応じて投資するS&P500連動型ファンドを変更すればいいでしょう。

詳しくは次の記事を参考にしてみてください。

まとめ:どれでもいいけど、迷ったら全世界株式!

- 【結論】全世界株式がオススメです

- どの国が成長するかは分からない

- 成長が期待できる新興国に投資可能

- 全世界株式、全米株式、S&P500に連動する投信を比較

太郎

太郎迷ったら、全世界株式くらいのイメージですね…

本記事では全世界株式をオススメしていますが、全米株式・S&P500でも全く問題はありません。

それよりも重要な点は

- 投資する金額を増やす

- 長く続ける

- インデックス投資を止めない

の3点でしょう。

資産運用は時間が命。時間さえ掛ければ投資で失敗することはないでしょう。

まだ証券口座をお持ちでない方は「SBI証券」がオススメです。

本記事で紹介したすべてのファンドに投資可能となっており、「投資の選択肢」を増やすことができます。

ネクシィーズ・トレードのサイトにジャンプします

次の記事も参考にしながら資産運用を始めてみてください。

それでは、また。